The shops were crazy on New Year’s Eve in Armenia, despite complaints about price increases here in 2017. Yet the country witnessed another dramatic increase in prices from the very beginning of 2018. This time there was an increase in customs duty on poultry, butter, vegetable oil and a number of other goods which will impact the price in the shops. There was rise also in excise tax rates on alcohol drinks, tobacco and fuel, so no Happy New Year for Armenian shoppers. According to economist Vahagn Khachatryan there is no justification for the increases –except that the government has budget problems to solve.

The Situation

Since August, 2017 the prices of butter, pork and beef meat, potato, fish, dairy products, petrol and a number of other basic necessities have increased. According to the National Statistical Service (NSS), the most overpriced products from January to November 2017 were: butter –up 40.7%, pork- up 40.3%, potato- up29.3%, fish- up 28.2%, and diesel fuel and petrol- up 16%. Every consumer is having to spend a lot more at the shops. The increases on these popular, everyday items is much higher than the average. According to official data, the average level of price increase was only 0.8% from January to November 2017.

This is explained by the fact that the index calculation of consumer prices includes 452 products and services—not just the essential 50 or so that have seen steep rises. And because the prices of some non-essential goods have decreased, the registered index of price increase was low. The increased price of basic foodstuff hits the poor particularly hard: “We would not feel the rise in prices of even pork or butter if we didn’t have so many poor people in our population. While 42.1% of average income is spent on food in Armenia, the poor spend more than 70% of their income on food,” says economist Vahagn Khachatryan and adds, “the things that have gone up by more than 10% are the most common daily buys. No wonder people are anxious”.

The price of Butter

Since butter has suffered the biggest price increase, Ampop.am is taking a closer look at its story. According to data from NSS, in January-November 2017 the price of butter increased by 40.7% to 4700 AMD from 3250 AMD per kg. Starting from September 2017 the State Commission for the Protection of Economic Competition (SCPEC) has continually referred to the increase in butter price emphasizing always that the price increase of butter in Armenia is linked to the rise of butter price in the world market since the mid of 2016. The commission’s reference to the increase in world prices is true, however butter prices in Armenia have grown and keep on growing beyond the world rate. According to the data on the Globaldailytrade website the international price for butter as of December 1, 2016 was $4290 per ton, which is $4.3 per kg. While at the same time period the price for butter in Armenia was $6.7 per kg, about $2.5 more than the international price.

Meanwhile in December 2017, the price of butter in the international market decreased by 25-30% to $4.4 per kg. In Armenia it increased to $9.8, that is $5.4 more than the international price. “If there was real economic activity, the price increase would be considered good. But, unfortunately, we live in a world where life gets harder and harder for people living in poverty here. The increase in international market prices has a direct impact on our market but the decrease does not, ” says Babken Pipoyan, head of the “Informed and Protected Consumer” NGO.

A number of circumstances predicate the price increase for meat. According to the Ministry of Agriculture, in 2017 unfavorable climate conditions resulted in a shortage of forage grass, so the price for grass grew affecting also the price of meat. On the other hand, livestock exports caused a price increase in the local market last year. According to the data of the State Customs Service, export of horned cattle from Armenia increased 5 times in the first quarter of 2017. As compared to January-June 2016, when the number of cattle exported was 1400 at a cost of $550.000, in 2017 this number grew to 6900 totaling $ 2.735.000.

The Argument

The price increase of some goods in the family food basket can have different causes. However, it is more important to evaluate the consequences of price increases from the perspectives of citizens’ solvency and social tension, especially in a country where 900.000 citizens or 29.4% of the population is poor, according to official data. As food prices have risen, it is not planned to raise salaries and pensions, according to the main financial document – budget 2018 (Read also Budget 2018: income, expense, deficit.).

It is expected that price increases will happen also for goods imported from non-EAEU countries. Due to the introduction of EAEU customs regulations, custom duties on a number of goods imported from the non-EAEU countries will raise from January 1, 2018. E.g. after the entry into force of Customs Code of the EAEU, customs duty on poultry meat imported from third countries will increase by 4%, butter by 1%, and vegetable oil by 2% etc.

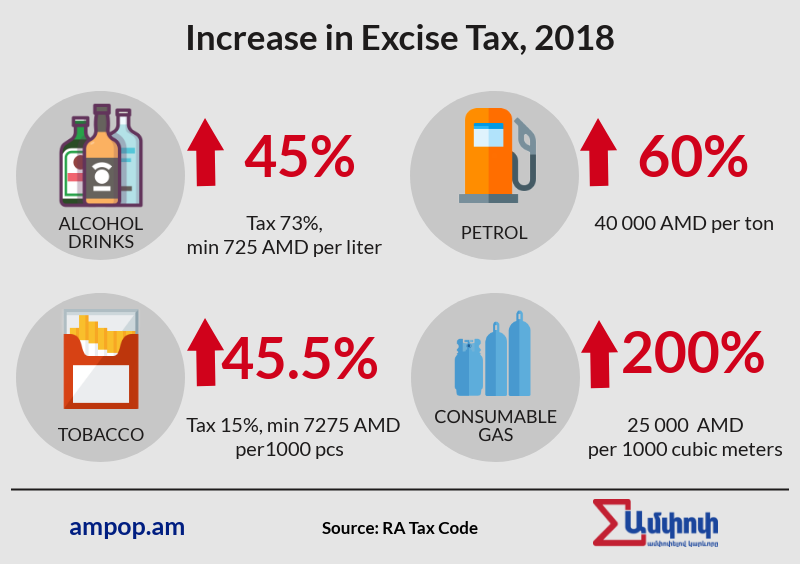

At the same time the new Customs Code of the EAEU comes into force, a review of excise tax rates will cause price increases in basic necessities.

The new excise tax rates mean that excise tax on alcohol drinks becomes 73% against the previously fixed 50% and the tobacco-15%. It becomes 7255 AMD against the current 5000 AMD per 1000 pcs; the excise tax of petrol becomes 40.000 AMD against 25.000 AMD per ton.

“The price increase on petrol and compressed gas will surely impact the overall price increase especially. The government should take measures at the expense of other goods to lighten the burden of price increase for the population. …We should promote local products during this period. If the price on poultry meat imported from a third country increases by 4%, then we should think over on how to export our own chicken rather than to consume the one imported from Russia,” says Babken Pipoyan.Excise tax of compressed gas is 25.000 AMD per 1000 cubic meter from January 2018. Previously it accounted for 8.330 AMD. Since January 2018 excise tax calculated in the production of natural compressed gas has increased by 16670 AMD. Taking into account that VAT – 3.300 AMD per 1.000 cubic meter – , then the total increase of taxes on this fuel is about 20.000 AMD per 1.000 cubic meter. From January, drivers have been paying 30-40 AMD more both per cubic meter of gas and per liter of petrol. There may be other increases of fuel prices during the year putting the burden of the excise tax on the consumers’ shoulders than on the suppliers.

Economist Khachatryan believes that the biggest issue is the lack of a middle class among the society in Armenia. The oligarchs gain more opportunities, whereas small and medium entrepreneurs are unable to grow their incomes and become rich. Unfortunately, they become poor because there are not equal competitive conditions and thus they cannot confront the competition. And this is due to a state policy,” concludes Khachatryan.

By Ampop Media

Infographics by Astghik Gevorgyan

Responsible editor: Suren Deheryan

Translated by Karine Darbinyan

For original article in Armenian, please CLICK HERE

ATTENTION © The copyright of stories and visualizations on Ampop.am belongs to “Journalists for the Future” NGO. It is forbidden to use Ampop’s content and images without active hyperlinks to the source website. Uploading of infographics and images of Ampop.am is possible only in case of an agreement reached with JFF.

Փորձագետի կարծիք

First Published: 20/06/2018