Since February 1, 2022, the introduction of liberalized market relations in the electricity market has provided solar plant operators with the opportunity to function independently and, if desired, participate in the purchase and sale of electricity.

In essence, prior to market liberalization, solar energy production plants had a sole buyer for the electricity they generated, namely the Electric Networks of Armenia (hereinafter, ENА). However, with the advent of liberalization, these plants now have the opportunity to seek alternative buyers, while compensating ENA solely for the distribution service they provide.

Before the introduction of the new market model, solar plants were classified into two types: licensed plants and autonomous producers. If the first type produced electricity and immediately sold it to ENA with a 20-year purchase guarantee (ENA was obliged to buy the electric energy produced by the plant for 20 years), then the second type of plants made a final calculation of the flows at the end of the year.

This suggests that if the plant generated more electricity than it consumed throughout the year, ENA would compensate the plant owner at the prevailing tariff rate for the surplus amount. Conversely, if the plant consumed more electricity than it produced, the plant owner would reimburse ENA for 1 kWh at the tariff rate established by the Public Services Regulatory Commission (PSRC).

Following the liberalization, autonomous producers gained the ability to form consumer groups and supply the majority of the electricity they generated to the consumers within those groups.

Produce in one place, consume in several places

What does it mean to create a consumer group? Individuals who desire to utilize solar energy but lack their own solar plant can join an autonomous producer who has such a plant. Together, they can form a group and negotiate a tariff with the plant owner for the electricity consumed. And pay only the distribution service fee to the ENA.

The consumers were provided with this opportunity due to the separation of the supply and distribution functions of ENA. However, it is important to note that the autonomous producer and the consumers within the formed group do not completely eliminate their reliance on ENA as a guaranteed supplier. At any given time, both the generating station owner and any member of the autonomous group can still obtain electricity from ENA through the cross-flows mechanism when needed.

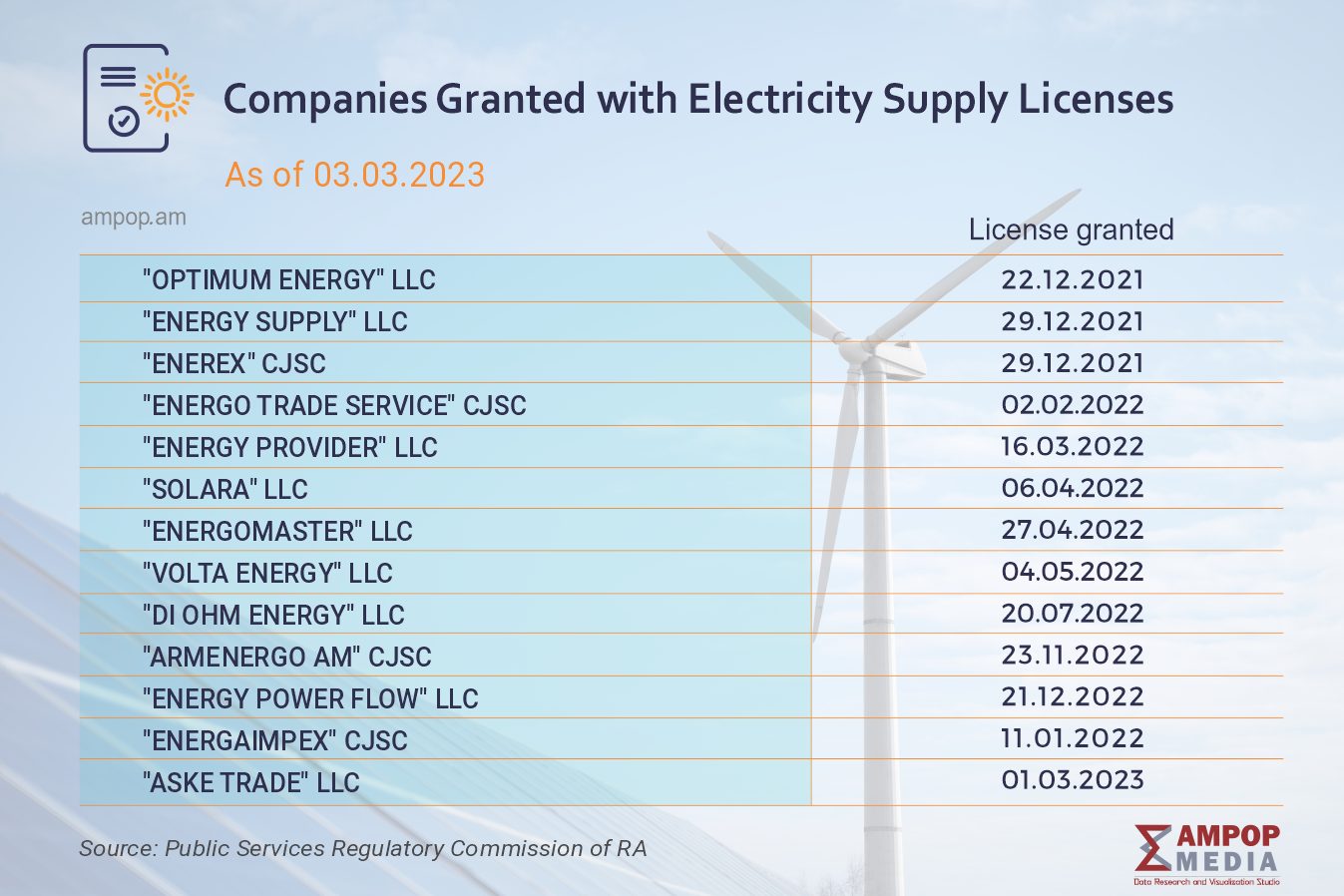

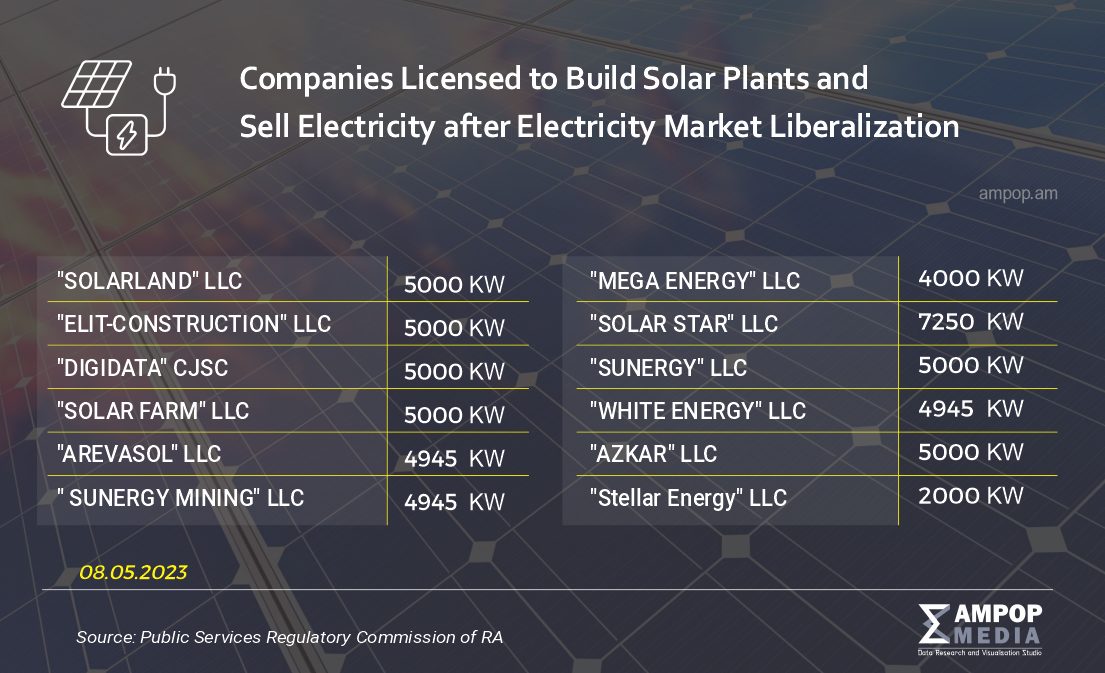

Power plants with a capacity exceeding 150 kW are required to apply for a suitable license from the PSRC (Public Services Regulatory Commission) before participating in the liberalized market. Conversely, if the plant’s power capacity is up to 150 kW, the producer can enter the liberalized market without the need for licensing.

Before the market model change, all licensed producers were provided with a purchase guarantee. However, following the liberalization in 2022 starting from February 1, it is no longer possible to construct a station with a purchase guarantee. If one intends to engage in solar energy production, they must submit a certificate of waiver of the purchase guarantee to the PSC (Public Services Commission) and enter the liberalized market.

Those who constructed a plant with a purchase guarantee prior to the market model change will continue to operate under the same conditions until the end of their contract. This means they will continue to produce electricity, and ENA will still purchase the generated power as per the terms of their agreement.

“In this scenario, when a manufacturer applies for and declines the purchase guarantee, all risks fall upon them,” highlights Ashot Ulikhanyan, head of the Tariff Department at the Public Services Regulatory Commission, in a talk to “Ampop Media”. Ulikhanyan emphasizes the importance for the producer to establish a solid customer base or “army” of consumers. Without such a consumer network, the producer may encounter difficulties in selling the energy they have generated.”

In general, both the autonomous producer and the group of consumers have a similar relationship with the ENA system. The main distinction is that the station, where a portion of the electric energy is both produced and consumed, does not pay for distribution or transmission services.

The “Ecoville” company, part of the OST Group, which has been active in the market since 2015 and is specialized in the installation and maintenance of solar panels, entered the liberalized market in 2022.

According to Emil Stepanyan, the deputy director of the company, constructing a solar plant offers significant advantages for business entities. Stepanyan believes that legal entities involved in commercial activities can benefit in two ways. Firstly, they can obtain a license to fulfill the energy requirements of their own companies. Alternatively, they can directly operate as a producer and sell electricity in the market.

Stepanyan suggests that after the market liberalization, there has been a noticeable increase in the number of individuals opting for the second option.

“We have clients who have purchased land, reclassified it for industrial purposes, and have proceeded to construct solar power stations. They now approach us with proposals for cooperation as suppliers. Essentially, these individuals view this endeavor purely as a business opportunity and seek to sell the entirety of the electricity they produce,” Stepanyan explains.

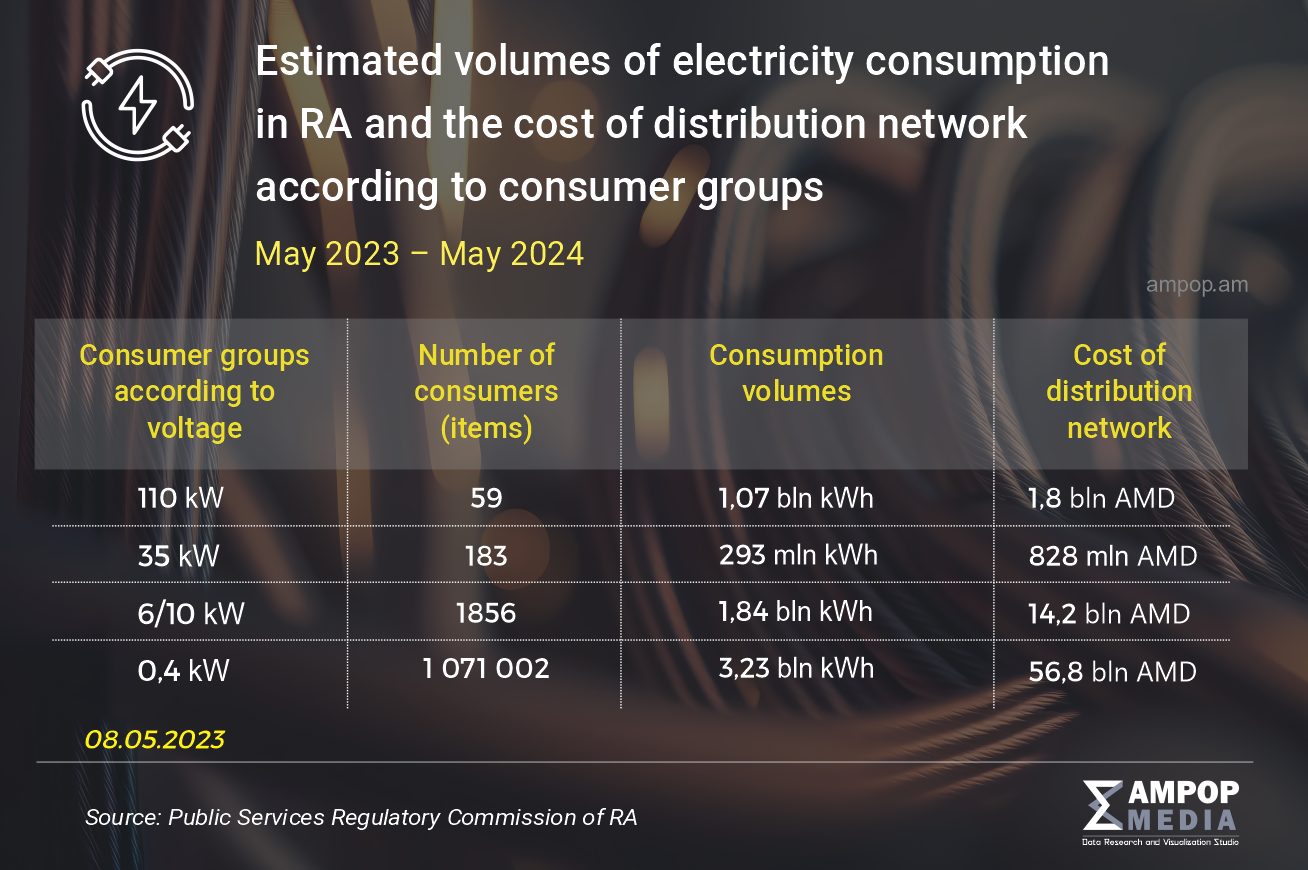

On a national level, the largest group of consumers, comprising approximately 1 million subscribers, are connected to the 0.4/0.23 kV network. This group primarily consists of households.

These subscribers are currently enrolled with ENA (Electric Networks of Armenia) and are likely to continue as such. They pay a fee of 48 or 53 AMD for each kilowatt (kW) consumed, out of which 21 AMD is allocated for the distribution service. This means that the portion to be paid for electricity on the balance sheet is significantly reduced due to the substantial distribution service fee.

“Consequently, selling electricity to this group would not only be unprofitable for the producer but also result in financial losses,” emphasizes the representative from “Ecoville”.

How are electricity tariffs generated?

In the previous electricity market model, the price of one unit of electricity, 1 kW, encompassed both the electricity cost and the distribution service tariffs. Generally, the distribution tariff was overlooked as the supplier and distributor were consolidated under ENA CJSC.

With the emergence of other suppliers in the market, the Public Services Regulatory Commission (PSRC) has established specific tariffs for the distribution service based on consumer groups, following the applicable methodology.

According to Ulikhanyan, the distribution service fee is determined for each consumer group based on the corresponding cost incurred on the distribution network. He explains, “Each consumer group is responsible for covering the cost proportional to its impact on the system. Consumers with a voltage of 110 kV have the lowest cost contribution within the entire system.”

Ulikhanyan explains that customers connected to the 0.4/0.23 kV voltage level pay the highest fees for the distribution service. This is because the distribution network relies on the utilization of both transmission lines and substations belonging to other consumer groups to deliver electricity to customers connected at the 0.4/0.23 kV level. As a result, the costs associated with using these shared resources contribute to the higher distribution service fees for these customers.

It appears that consumers who are connected to lower voltage levels in the electrical network cause higher costs in the distribution system. Specifically, for customers connected to the 0.4/0.23 kV network, the delivery of electricity from one point to another involves the utilization of various voltage lines such as 110 kV, 35 kV, 6(10) kV, and the 0.4/0.23 kV lines and substations.

As per the tariffs in effect from February 1, 2023, the expenses associated with the entire distribution network, including network maintenance and investment recovery, will likely amount to 73.6 billion drams annually. Out of this total, an estimated 7.9 billion drams will be the potential electricity losses. These figures were emphasized by a representative from the Public Services Regulatory Commission (PSRC).

The expenses related to the distribution network need to be covered jointly by the HEC and the participants of the free market.

Highlighting the objective of market liberalization to establish equitable pricing, Ashot Ulikhanyan emphasizes:

“For certain groups of ENA consumers, such as those who are socially insecure or have low consumption, the set tariffs may not completely cover the expenses associated with the distribution service.”

This circumstance, perhaps, poses a challenge for solar electricity producers entering the free market. Additionally, the task of finding buyers is further complicated by the fact that producers of other types of electricity, such as nuclear power plants and hydropower plants, often have the advantage of selling their products at a lower price.

“The price of electricity generated by the nuclear plant is 15.4 AMD without VAT, while the price of electricity generated by the solar plant is at least 20-22 AMD without VAT. Selling electricity at a lower price is not profitable,” explains the deputy director of “Ecoville”.

However, it is evident that the competitive nature of the market has encouraged all electricity producers to become increasingly flexible in their approach.

Author: Lilit Poghosyan

Photo by the author

Infographics by Anush Baghdasaryan

This article has been written in the framework of the “Access to Energy” project in cooperation with the Friedrich Ebert-Stiftung (FES).

More articles about #EnergySecurity

© All the stories, infographics and other visuals bearing the Ampop Media logo is possible to publish on other audiovisual platforms only in case of an agreement reached with Ampop Media and/or JFF.

Փորձագետի կարծիք

First Published: 19/05/2023